Trading Screen Order Management System

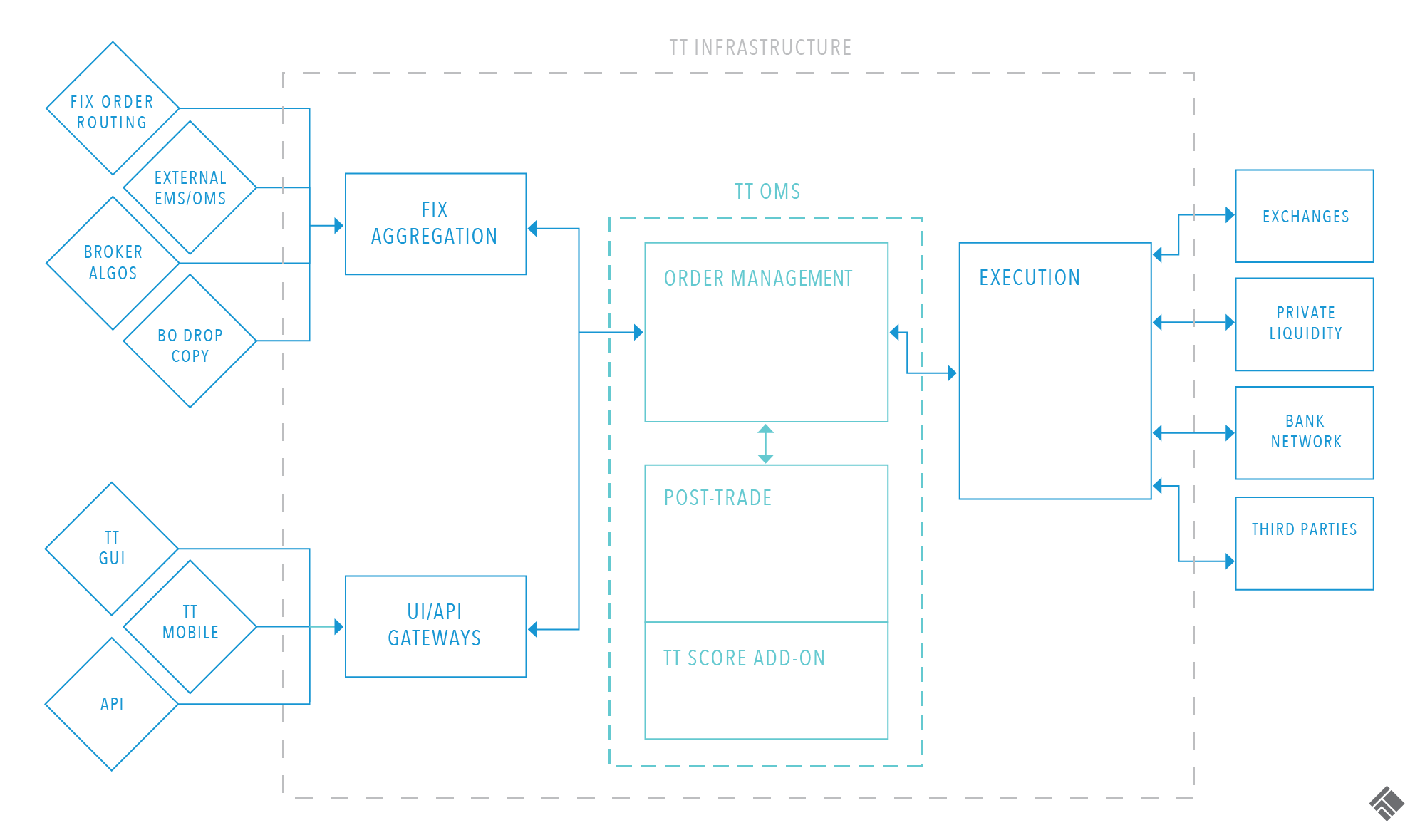

Order management position keeping exposures profit loss risk rebalancing allocations valuation and compliance services.

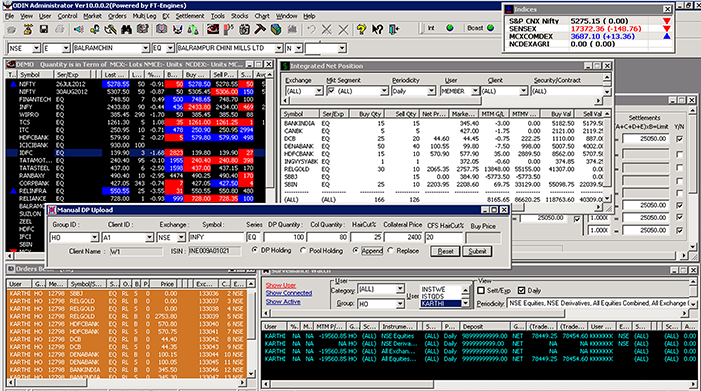

Trading screen order management system. The data contained in this website is not necessarily real time nor accurate and analyses are the opinions of the author. The integration of tradingscreen with thinkfolio ensures that mutual clients benefit from a standardised and certified interface between the two platforms which. Many features of bidfx include embedded data aggregation and analysis to. Tradingscreen is proud to announce that linear investments has selected tradeprime tradingscreen s comprehensive front office solution which includes execution management order management compliance risk multi prime broker and administrator connectivity for hedge funds all delivered through the cloud.

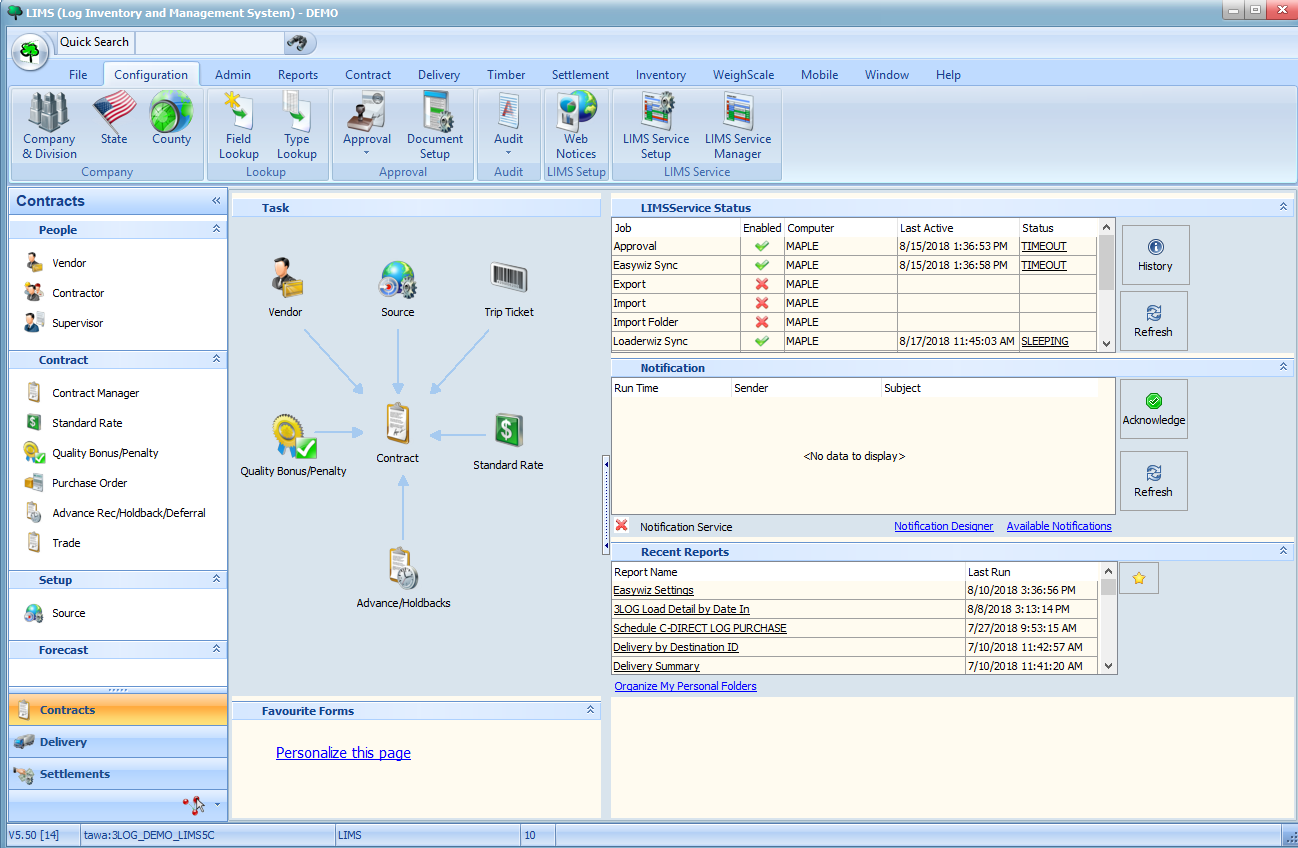

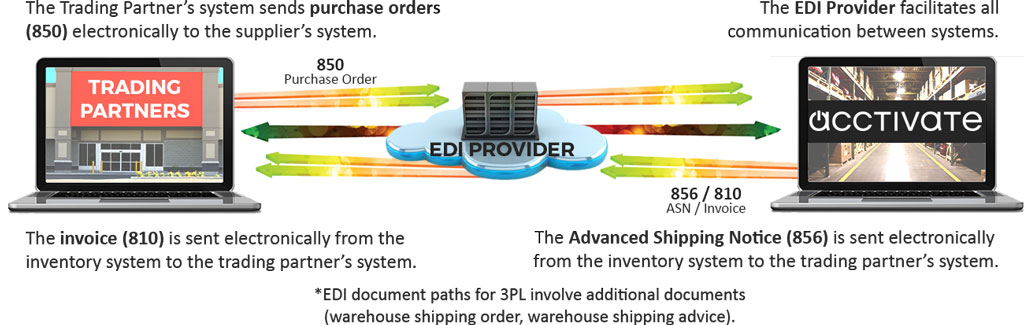

Singapore 12 july 2020. An order management system is a software system that facilitates and manages the execution of trade orders. 7 binary options will not be held liable for any trading screen order management system loss or damage resulting from reliance on the trading screen order management system information contained within this website. Our oms is an integrated system that helps manage the key activities necessary for operating your firm.

Linear investments selects tradingscreen s tradeprime. Managers can use this information to identify potential problems and optimize processes to keep purchasing and fulfillment running smoothly. Order management systems when a buy side firm wants to use an ems to stage orders for liquidity typically it realises that it needs better technology to interact with the market and orders says paul reynolds head of fixed income at ems provider tradingscreen. Tradingscreen launches forex specific ems platform spin off bidfx systems which was spun off in 2017 as a division of tradingscreen a provider of multi asset execution and order management system counts hedge funds asset managers and regional bankers as its clients.

In the financial markets an order must be placed in a trading system to execute a buy. Order management systems when a buy side firm wants to use an ems to stage orders for liquidity typically it realises that it needs better technology to interact with the market and orders says paul reynolds head of fixed income at ems provider tradingscreen. That s where an order management system oms comes in.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

:max_bytes(150000):strip_icc()/BuyandWrite_Website-efcd5273c0e9454cb231d96cb07ad629.png)